Every year, the income tax statement of the Union Budget is one of the most eagerly anticipated. The fact that FM Sitharaman did not announce any changes to the income tax rates for 2022–2023 was a major letdown for the salaried class. Additionally, the tax rates for 2022–2023 were left unchanged.

Nirmala Sitharaman suggested raising the tax deduction ceiling for both Centre and state government employees from 10% to 14% when presenting the Union Budget 2022. The transfer of any virtual digital asset will be subject to a 30 per cent tax, according to the Finance Minister’s Budget proposal to lower the corporate levy. The corporate surcharge will drop from 12 to 7 percent. I want to make it such that any income from the sale of a virtual digital asset will be subject to a 30% tax. With the exception of acquisition costs, no deduction for any expense or allowance must be permitted when calculating such income, the speaker said.s.

The government has implemented a 30% tax on cryptocurrency revenue, with the cost of acquisition being the only item that may be deducted. The beneficiary of the virtual asset donation will also be subject to tax. This clarifies the taxation of cryptocurrencies, however, there are many different forms of crypto-related incomes, so maybe the Budget documents will provide even more clarification.

New tax regime

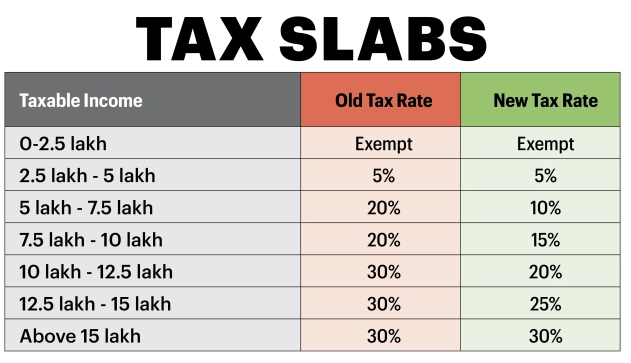

Sitharaman announced a new tax system in the 2020 budget, but she left the tax slabs and rates alone. For those who are ready to forgo tax breaks and deductions under the new tax system, tax rates are reduced. Taxpayers can choose whether or not to use the new tax system. This indicates that a taxpayer has the option of continuing with the current system or switching to a new one.

- Both regimes currently exempt income up to $2.5 from taxation. Income between 2.5 and 5 lakh is taxed at a rate of 5% under both the old and new tax regimes.

- Personal income ranging from 5 lakh to 7.5 lakh is taxed at a rate of 10% under the new regime.

- Under the new law, income between 7.5 lakh and 10 lakh is taxed at a rate of 15%.

- However, there are three slabs above 10 lakhs under the new regime.

- Personal income between ten lakh and twelve lakh rupees is taxed at a rate of 20% under the new regime.

- Income ranging from 12.5 lakh to 15 lakh is taxed at a rate of 25%.

- Income over Rs 15 lakh is taxed at a rate of 30%.

Old tax regime

- Both regimes currently exempt income up to $2.5 from taxation.

- Income between 2.5 and 5 lakh is taxed at a rate of 5% under both the old and new tax regimes.

- Under the old regime, personal income ranging from 5 lakh to 7.5 lakh was taxed at a rate of 15%.

- In the old regime, income between 7.5 lakh and 10 lakh was taxed at a rate of 20%.

- Personal income over ten lakh rupees was taxed at a rate of 30% under the previous regime.

The income tax brackets have not changed since 2014. In 2014, the basic personal tax exemption limit was last revised. When Prime Minister Narendra Modi’s government presented its first budget in 2014, then-Finance Minister Arun Jaitley raised the basic income tax exemption limit from 2 lakh to 2.5 lakh. The exemption limit for senior citizens has been raised from 2.5 lakh to 3 lakh. Since then, the basic exemption limits have remained unchanged